Oasis believes Tokyo Dome Corporation can meaningfully improve its performance by:

1) Improving operations at Tokyo Dome;

2) Improving operations at the Tokyo Dome Hotel or bringing in an external manager;

3) Exploring partnerships for the Tokyo Dome City Attractions theme park;

4) Disposing of non-core assets; and

5) Improving corporate governance.

We think implementing these changes will allow the Company to realize its full potential and result in over 100% upside to the current stock price.

1. Improving operations at Tokyo Dome

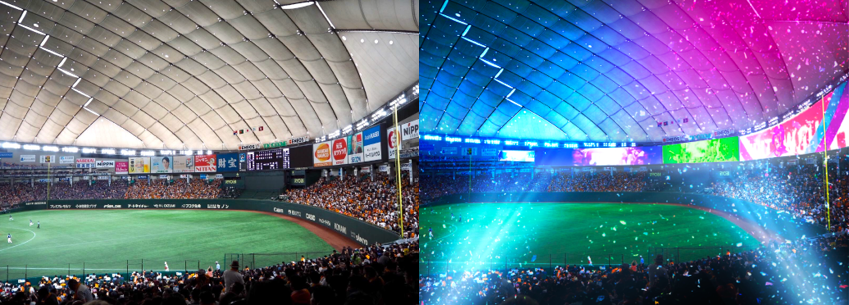

The Company’s first priority should be upgrading Tokyo Dome, which will help boost profitability and enhance the fan experience. Installing IPTV and digital signage should be at the top of the Dome’s upgrade list. This improvement will give the Company more flexibility when engaging with sponsors and advertisers, and will increase high-margin advertising revenue. It will also open up the Tokyo Dome to hosting more events, reducing potential issues around sponsor conflicts.

The Company should also review naming rights and sponsorship opportunities. We note that naming rights and sponsorship deals are increasingly popular in Japan; and have the potential to bring in tens of billions of Yen in revenue, which Tokyo Dome presently forgoes.

Global japanese companies already participate in stadium naming and sponsorship

Technology is essential to enhancing stadium experiences, and better Wi-Fi access, beacons, RFID tracking, and virtual reality experiences are all now part of the fan experience in modern stadiums. Technology is also improving service, including e-ticketing, in-seat service, electronic menu boards to reflect product and pricing changes, information on queue times and facilities, and bespoke in-stadium content. Better data and customer insights are also key for sales and marketing of season tickets and premium products. There is significant scope for the Company to invest in upgrading technology at Tokyo Dome, which would dramatically improve the fan experience, allow for better commercial opportunities, and provide a point of differentiation.

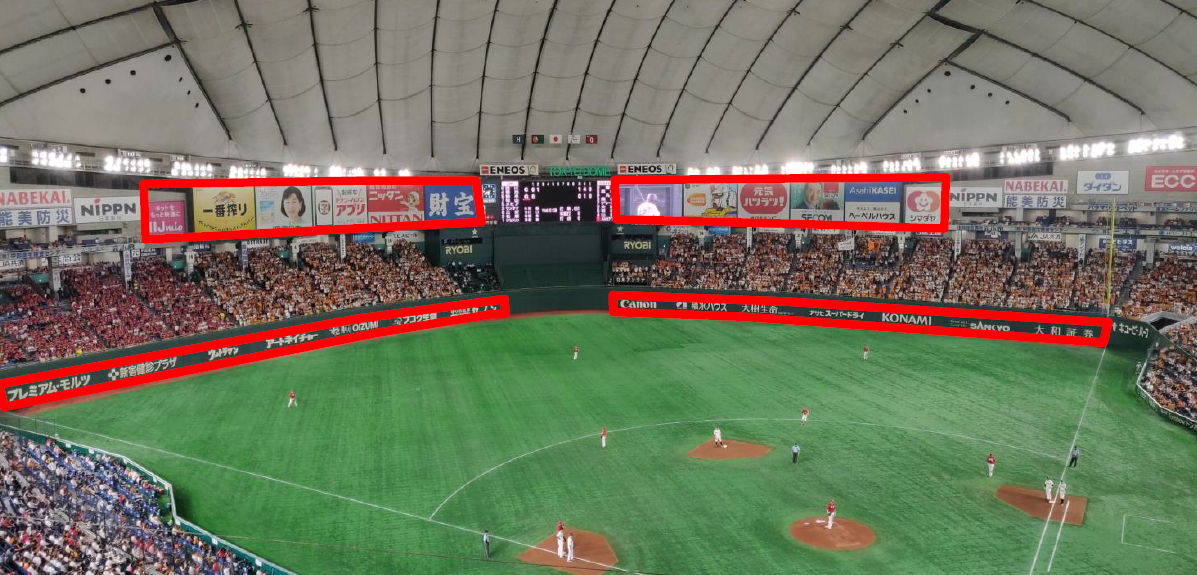

Areas where TOkyo Dome could add LED signage

Tokyo Dome should also focus on boosting revenue for food and beverage (“F&B”) offerings, as its average F&B revenue per head falls short compared to other top baseball stadiums. We believe this can be improved by increasing the cooking space available to food vendors, which is currently limited to kiosks located in the outfield, according to our research. As a result, fans underspend on food by opting for snacks, prepackaged meals, or even food brought from home and beer purchased at nearby convenience stores. A trip to Tokyo Dome should be a culinary experience, with premium cuisine and drinks from around Japan and the world available throughout the stadium and throughout the entire duration of the event.

Tokyo Dome concourse food stall compared to new white hart lane in london

Additional renovations that the Company should consider include an upgrade of the Dome’s hospitality facilities on par with that of world-class peers and in line with the standards expected by corporates. Tokyo Dome should also consider redesigning its revolving door entrances and standing room around the infield, which contribute to crowd control issues that must be managed by hired staff, adding unnecessary expenses to the Company’s operations.

2. Improving operations or engaging an external manager to operate Tokyo Dome Hotel

Oasis believes that Tokyo Dome Hotel’s performance can be improved dramatically either internally or by entering into a management agreement with a global hotel operator, such as Hyatt or Marriott. Aside from improving the overall guest experience, these large-scale brands are especially skilled at driving group business and would help the hotel capitalize on its attractive MICE offerings. Additionally, working with a global hotel operator will give Tokyo Dome Hotel access to a central reservation system, providing it with insightful data to optimally price its hotel nights. Overall, we think that partnering with an external brand manager will lead to meaningful margin expansion and top line growth at Tokyo Dome Hotel, and urge management to explore this option.

3. Exploring partnerships for the Tokyo Dome City Attractions theme park

Tokyo Dome City Attractions must increase its in-park spending by offering customers more appealing attractions and unique experiences. The park must aim to be a truly world-class theme park, anchored in unique, memorable attractions that people want to see over and over again. Otherwise, it will risk becoming a collection of outdated rides with no over-arching theme, that could be located 30 years ago, anywhere in the world.

Oasis believes the most effective way to achieve this is to partner with a Japanese content creator, such as Capcom, Square Enix, or Bandai. The success of this strategy has already been proven in Japan with the hotly anticipated opening of Super Nintendo World at Universal Studios Japan, and the success of Tokyo Disney, Sanrio Puroland, and numerous other attractions. Likewise, we believe this will help Tokyo Dome City Attractions dramatically improve its offering and capitalize on customers’ increasing willingness to spend on experiences.

3. Disposing of Non-core Assets

Tokyo Dome Corporation owns and operates Atami Korakuen Hotel, an onsen resort located an hour away from Tokyo by train, as well as Matsudo Keirin Racetrack, a velodrome located outside of Tokyo. Together, these two facilities were only responsible for 5% of the Company’s 2019 revenue, but have diverted Management’s attention away from maximizing profit in areas with the most potential.

To realize the true potential of the Tokyo Dome, Hotel, and theme park in line with our suggestions, we believe it would be helpful for the Company to dispose of these non-core assets. By selling these assets, the Company can devote more time to improving its core operations and also generate cash to invest in facility improvements.

4. Improving Corporate Governance

Along with its assets, Tokyo Dome Corporation’s corporate governance needs an update.

As of fiscal year 2019, the Company’s compensation scheme featured a 92% fixed pay ratio – a structure that does not adequately incentivize management to reach company goals and improve performance. We believe Tokyo Dome Corporation should restructure its compensation scheme to include a significant variable pay component based on achieving quantifiable goals, and disclose these goals to investors.

Tokyo Dome Corporation can also improve the composition of its Board of Directors, with a focus on enhancing diversity and independence. The Board should add female Directors to improve diversity and broaden its perspective. The 10-person Board has only three independent members, falling short of the one-third target set by Japan’s Corporate Governance Code. We note that all of these so-called independent directors have been with the Company for over 12 years. Such long tenures are likely to lead to entrenchment and impair independence, not to mention contribute to a lack of fresh perspective. Oasis urges the Board to add younger, truly independent directors with relevant experience who can better relate to Tokyo Dome Corporation’s target customers. To further improve Board independence in line with global standards, the Company should also separate the Chairman and President positions, both currently held by Mr. Tsutomu Nagaoka.

Oasis believes that these changes can nearly double net income, and, when combined with the higher multiples achieved by listed exhibition venues with growing earnings, can achieve greater than 100% returns for shareholders.

forecasts based on Oasis estimates

We believe Tokyo Dome can deliver a truly premium, best-in-class experience, which will benefit all event attendees, hotel guests, employees, theme park-goers, suppliers, vendors, customers, and shareholders.

We are convinced that by implementing our suggested changes to its operations and corporate governance, Tokyo Dome can hit a home run. We look forward to fruitful engagement and working together with management to build A Better Tokyo Dome.